How to improve and increase your CIBIL Score?

Banks and financial institutions generally ask that you submit your CIBIL report as part of the documentation process when you apply for a loan. This report reveals your credit history, which in turn determines whether or not you are eligible for a loan. Lenders always prefer an applicant with a high CIBIL score. So, what do you do if you receive a CIBIL report that is less than ideal? Here are some helpful tips about how you can increase your CIBIL score.

What is a CIBIL score?

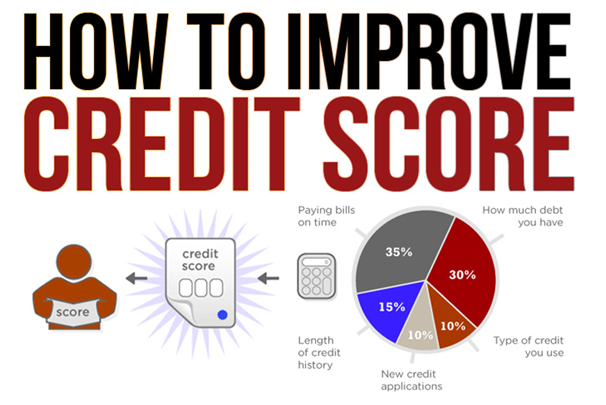

A CIBIL score is basically a numerical representation of your entire credit history and credit worthiness. It is a three-digit number that ranges between 300 and 900. As a rule of thumb, a CIBIL score of more than 650 or 700 is considered to be favorable. A CIBIL report generally accompanies your CIBIL score, and it contains a history of all of your credit repayments over a specific time period. It also includes all the details about the various types of loans and credit facilities that you have availed from credit institutions.

Getting your own report is really easy. You can even check your CIBIL score online right this instant without ever leaving the comfort of your own home. There are also plenty of online portals that offer free CIBIL score analysis. You can get a free Financial Health Check Report on Finserv MARKETS, complete with a personalized analysis, simplified data, and valuable insights.

Source: wealthtyre.com

What can you do to improve your CIBIL score?

Getting a CIBIL score that is less than ideal is an unfavorable situation to find yourself in. However, it’s certainly not irreparable. Since your score isn’t set in stone, there are plenty of steps that you can take to improve your credit rating. Here are 5 things that you can do.

Source: moneygossips.com

Limit your borrowings

It has now become quite easy to obtain loans from banks and financial institution. This development, while mostly favorable, can sometimes lead you to get carried away since it can be tempting for you to frequently resort to borrowing. Unfortunately, the more the number of loans you take, the further your CIBIL score may fall. This is because taking on too many loans can make you appear credit-hungry, thereby affecting your credit worthiness. So, it’s advisable to only take a loan if it is absolutely necessary.

Utilize your credit card wisely

Any amount outstanding on your credit card is considered to be an unsecured loan. Not only is the interest charged on such amounts exorbitantly high, but it can also adversely impact your CIBIL report by a great degree. To increase your credit score, use your credit card carefully and ensure that you pay all of your credit card dues in full and on time. Paying only the minimum amount every month can also make your credit score take a dive.

Repay your loans on time

This is probably the easiest way to get your credit score back up in no time. Not repaying your loans within the due date can severely damage your CIBIL score. And it doesn’t stop with just that, as failure to repay your debt can attract penalties and interest, which may then quickly lead you into a debt trap that can be hard to get out of. You can even verify this yourself if you check CIBIL score after paying off all your loan EMIs on time. On doing so, you’ll find that this strategy improves your credit rating significantly.

Retain your credit history

Your CIBIL score is dependent on your credit history. So, it’s a good idea to not surrender your credit cards if you’ve been repaying all your bills on time. Retaining your old credit cards and keeping them active can lengthen your credit history and give you an active credit trail. This, in turn, proves useful when a credit institution is evaluating your credit worthiness, since the trail would reveal that you’ve been disciplined and prompt with your repayments all along. A strong credit history with no default in repayments can increase the score on your CIBIL report.

Limit the frequency of credit applications

Refraining from repeatedly applying for loans can actually help improve your CIBIL score. Each time you submit an application for credit, the lender makes a hard inquiry with the credit evaluator. And since every inquiry is recorded on your report, making too many credit applications within a short span of time can make you appear credit-hungry. This does not reflect well with lenders. So, the next time you suffer a credit rejection, give it some time before you make an application for a loan again.

If you check your CIBIL score and find that it’s ideal, you can apply for personal loans online and obtain an unsecured borrowing of up to Rs. 25 lakhs. Finserv MARKETS also gives you other benefits such as quick loan approval in just about 3 minutes, and flexible repayment options ranging from 12 months to 60 months. Furthermore, with the EMI calculator and eligibility calculator available online on any web portal, you can evaluate your eligibility for a personal loan and get a better idea of your repayment schedule.