Develop a professional trading strategy by using the indicator

Indicators are widely used by different levels of traders. The functions of indicators greatly vary and the traders tend to use them according to their requirements. In fact, some traders are using complex indicators to make significant progress in their life. So, how can we make a professional trading strategy by using the indicator? You might be thinking that it is a very complex process. But if you follow some key guidelines, you may use the indicators in a very structured way to create your trading strategy.

This article is going to act as your guide to develop your trading system based on the most popular indicator. If you go through this article, we can assure you that you will learn a lot about the most prominent indicators used in professional trading strategies.

Use of moving average

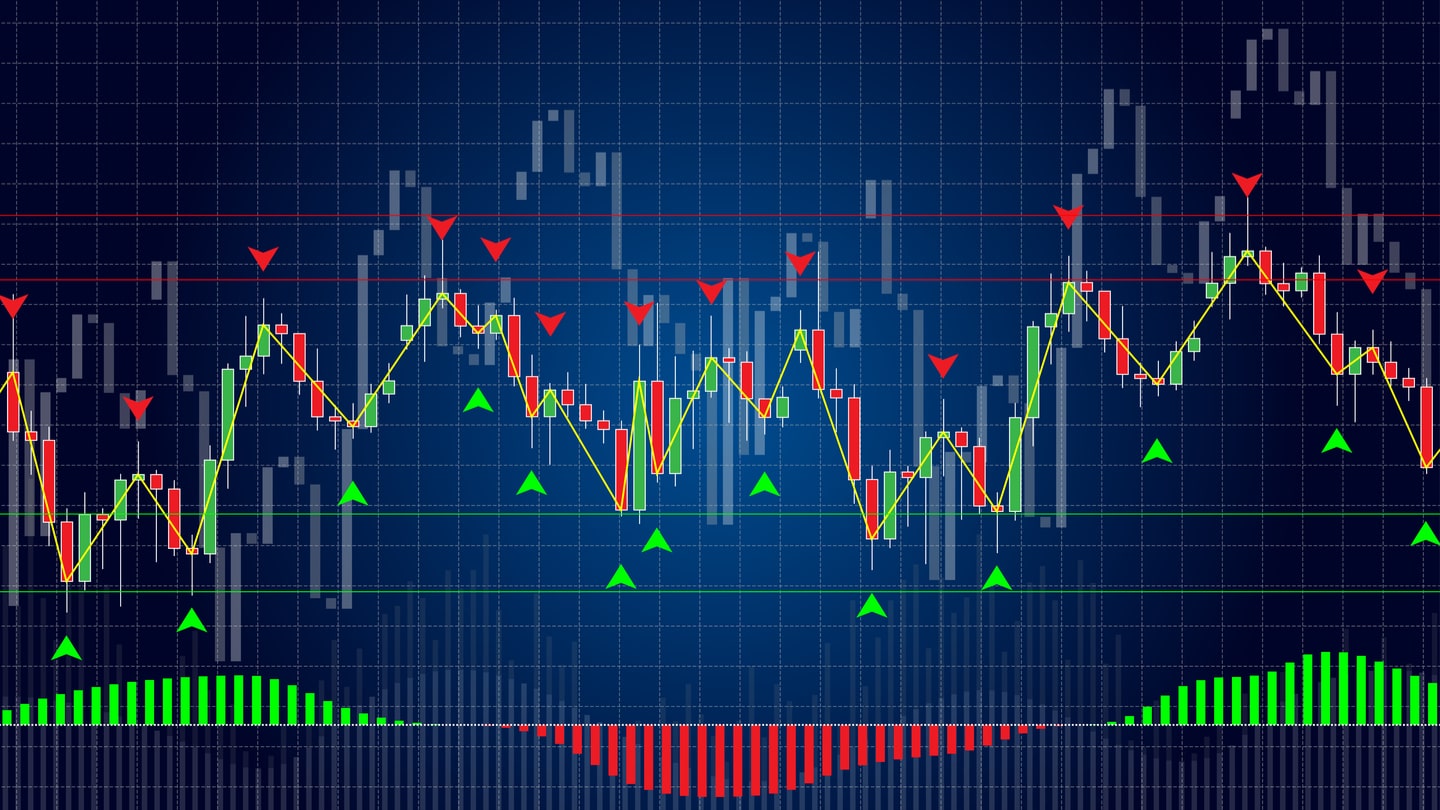

The traders take their trades by using the moving average. The moving average gives the retail traders a clear clue about the support and resistance level. Set the period to 100 and check the price movement in the H1 or the H4 time frame. Soon you will realize that the period moving average is acting as the support and resistance level. So, you don’t have to work hard to find the support and resistance level manually. Once you learn to use the moving average to find the dynamic support and resistance level, you have to learn some advanced techniques.

Basic candlestick patterns

Taking the trades at the important dynamic support and resistance level is going to be an immature act. If you want to protect your trading capital, you should be taking the trades with low risk. For that, you have to learn about the basic candlestick patterns. Once you become good at analyzing the important candlestick pattern, you will become much more confident with your actions. Never think that you know every bit of detail about the market. Try to get more explanation about the candlestick pattern so that you can trade the market with much more confidence.

Using the fundamental data

Your trading system will be incomplete if you take the trades based on the technical data only. You have to learn about the fundamental analysis process and look for the best trade signals in the market. People often thinking analyzing the fundamental data in the market is a very tough task. But if you ask the professional trader, you will realize that analyzing the fundamental details of the market is one of the easiest tasks in the market. Blend the technical and the fundamental data. Integrate with your price action trading strategy so that you can find the trade setup with much more confidence.

Backtest your trading strategy

By now you know the basics to create a professional trading strategy by using the indicator. Once you have done that, you need to test the performance of your trading strategy. Without testing the performance of the trading system, it is going to be a very tough task to find the best possible deals in the market. You may think you may know a lot about the market. But this should not encourage you to do the backtesting. It is the only process by which you can know that your trading system is working properly. And make sure you do the backtesting with a professional broker like Saxo to avoid technical problems.

Develop your risk management rule

Once you know your trading system works, you have to create your risk management rule. You should not be trading the market when the risk factors are very high. For instance, the maximum risk which you may take as a trader should never exceed 2% of your account balance. If it does, you will are going to have a tough time recovering from the loss. And learn to ride the trend using the trailing stop loss as it will improve your recovery factor and boost your trading confidence.